AI and the Retail Marketer’s Future

How AI transforms strategy and processes, driving the adoption of Positionless Marketing

Exclusive Forrester Report on AI in Marketing

RFM segmentation is a marketing analysis method that involves analyzing customer behavior based on three key factors: recency, frequency, and monetary value. This RFM analysis helps businesses categorize customers into segments, enabling targeted and personalized marketing strategies.

This RFM methodology helps businesses categorize customers into distinct segments, allowing for more effective and targeted marketing strategies tailored to their specific engagement and spending patterns.

This article will provide you with the ins and outs of RFM segmentation - what it means, how to do RFM analysis, and how to perform RFM segmentation effectively.

RFM stands for recency, frequency, and monetary. This methodology, known as RFM analysis or RFM customer segmentation, involves evaluating customer behavior based on their transaction recency, frequency, and monetary value. The primary aim is to understand and categorize customers based on their recent purchases, transaction frequency, and overall spending, allowing businesses to implement effective marketing strategies.

RFM analysis allows marketers to target specific clusters of customers with communications that are much more relevant for their particular behavior – and thus generate much higher rates of response, plus increased loyalty and customer lifetime value. Like other segmentation methods, an RFM model is a powerful way to identify groups of customers for special treatment..

Marketers typically have extensive data on their existing customers – such as purchase history, browsing history, prior campaign response patterns and demographics – that can be used to identify specific groups of customers that can be addressed with offers very relevant to each.

While there are countless ways to perform segmentation, RFM analysis is popular for three reasons:

The three quantifiable factors in the RFM model are recency, frequency and monetary. Below we will explain each factor in detail.

Underlying the RFM segmentation technique is the idea that marketers can gain an extensive understanding of their customers by analyzing these three quantifiable factors::

The following is a step-by-step, do-it-yourself approach to RFM segmentation. First, we will take a look at RFM Modeling.

RFM modeling is a powerful approach to customer segmentation in marketing, standing for recency, frequency, and monetary. This model involves evaluating customer transactions based on how recently they occurred, the frequency of transactions, and their monetary value. Using RFM modeling and RFM segmentation, businesses can gain valuable insights into customer behavior, allowing for more targeted and effective marketing strategies.

Building an RFM model is a structured methodology that starts with the collection and analysis of customer data. This process includes assessing the recency of purchases, the frequency of transactions, and the monetary value associated with each transaction. Once this data is gathered, businesses utilize the RFM methodology to assign numerical scores to each parameter, facilitating the categorization of customers into specific segments. This method is a key aspect of customer segmentation using RFM analysis, providing businesses with a systematic approach to understanding and responding to the diverse needs and behaviors of their customer base.

With the right tools, RFM segmentation can be done automatically, using marketing AI, for more accurate results.

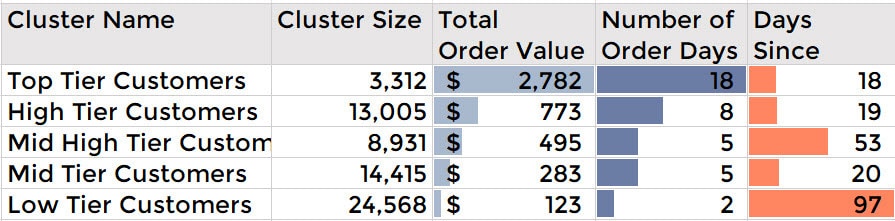

Optimove employs a sophisticated and data-driven approach to RFM segmentation. The platform integrates rich historical, real-time, and predictive customer data to assess three crucial factors: recency, frequency, and monetary value. The system then uses advanced algorithms and artificial intelligence to analyze this data and assign numerical scores to each parameter.

With this numerical representation of customer behavior, Optimove's RFM segmentation enables businesses to categorize their customer base into distinct segments. These segments help identify and understand different customer profiles, allowing for targeted and personalized marketing strategies. By automating the RFM segmentation process, Optimove ensures that businesses can efficiently leverage this powerful methodology to enhance customer engagement, drive loyalty, and optimize marketing efforts.

Note that with the aid of software, RFM segmentation – as well as other, more sophisticated types of segmentation – can be done automatically, with more accurate results.

The first step in building an RFM model is to assign Recency, Frequency and Monetary values to each customer. The raw data for doing this, which should be readily available in the company’s CRM or transactional databases, can be compiled in an Excel spreadsheet or database:

The second step is to divide the customer list into tiered groups for each of the three dimensions (R, F and M), using Excel or another tool. Unless using specialized software, it’s recommended to divide the customers into four tiers for each dimension, such that each customer will be assigned to one tier in each dimension:

| Recency | Frequency | Monetary |

| R-Tier-1 (most recent) | F-Tier-1 (most frequent) | M-Tier-1 (highest spend) |

| R-Tier-2 | F-Tier-2 | M-Tier-2 |

| R-Tier-3 | F-Tier-3 | M-Tier-3 |

| R-Tier-4 (least recent) | F-Tier-4 (only one transaction) | M-Tier-4 (lowest spend) |

This results in 64 distinct customer segments (4x4x4), into which customers will be segmented. Three tiers can also be used (resulting in 27 segments); using more than four, however, is not recommended (because the difficulty in use outweighs the small benefit gain from the extra granularity).

As mentioned above, more sophisticated and less manual approaches – such as k-means cluster analysis – can be performed by software, resulting in groups of customers with more homogeneous characteristics.

The third step is to select groups of customers to whom specific types of communications will be sent, based on the RFM segments in which they appear.

It is helpful to assign names to segments of interest. Here are just a few examples to illustrate:

Marketers should assemble groups of customers most relevant for their particular business objectives and retention goals.

The fourth step actually goes beyond the RFM segmentation itself: crafting specific messaging that is tailored for each customer group. By focusing on the behavioral patterns of particular groups, RFM marketing allows marketers to communicate with customers in a much more effective manner.

Again, here are just some examples for illustration, using the groups we named above:

Of course, deciding which groups of customers to target and how to best communicate with them is where the art of marketing comes in!

RFM segmentation is a straightforward and powerful method for customer segmentation. However, the fact that the RFM model only looks at three specific factors (albeit important ones) means that the method may be excluding other variables that are equally, or more, important (e.g., products purchased, prior campaign responses, demographic details).

Also, RFM marketing is, by its nature, an historical method: it looks at past customer behavior that may or may not accurately indicate future activities, preferences and responses. More advanced customer segmentation techniques are based on predictive analytics technologies that tend to be far more accurate at predicting future customer behavior.

RFM segmentation itself is a traditional marketing methodology that does not inherently involve machine learning. It's a rule-based approach to segmenting customers based on historical data related to their recency, frequency, and monetary behavior.

However, in modern marketing analytics and customer relationship management (CRM), machine learning techniques may be employed to enhance the segmentation process. RFM Machine learning algorithms can analyze more complex patterns and consider a broader range of variables beyond RFM, providing more sophisticated and dynamic customer segmentation.

In summary, while RFM segmentation itself is not a machine learning technique, RFM machine learning can be applied in the broader context of customer segmentation and analysis to uncover more nuanced patterns and insights.

Optimove is a Relationship Marketing Hub that combines the most advanced customer segmentation, modeling and predictive analytics technologies, along with an automated customer marketing orchestration platform that supports both pre-scheduled and realtime campaigns. Optimove’s RFM software is advanced and easy to use. The company’s customer RFM segmentation software helps marketers implement a systematic approach to planning, executing, measuring and optimizing a complete, highly personalized customer marketing plan.

Optimove executes RFM segmentation by leveraging advanced analytics to assess customer behavior based on recency, frequency, and monetary values. The platform employs sophisticated algorithms to analyze transaction data, enabling businesses to categorize customers into distinct segments and tailor marketing strategies to effectively engage each group.

Request a Web demo to learn more about how you can use Optimove to automate a complete system of highly personalized customer marketing activities that increase long-term customer loyalty and lifetime value.

Exclusive Forrester Report on AI in Marketing

In this proprietary Forrester report, learn how global marketers use AI and Positionless Marketing to streamline workflows and increase relevance.