AI and the Retail Marketer’s Future

How AI transforms strategy and processes, driving the adoption of Positionless Marketing

Optimove Connect 2026: Join us in London on March 11–12 to master Positionless Marketing

Deliver personalized, compliant, and revenue-driving moments across banking, insurance, and beyond

Orchestrate personalized client journeys with full compliance—without sacrificing speed or marketer independence

Deliver personalized experiences without risking trust or compliance

Deliver highly relevant, data-driven communications across email, SMS, mobile, and web with built-in data governance.

Be audit-ready with GDPR, CCPA, and more by automatically managing opt-outs, consent, and logs, so your marketing stays fast and frictionless.

Reinforce brand trust by connecting with clients through timely, compliant, and personalized communications across channels.

Turn deeper understanding into bigger growth

Unify financial behaviors, holdings, and lifecycle signals into a single, evolving client view.

Use real-time insights to act the moment new opportunities or risks emerge with AI decisioning.

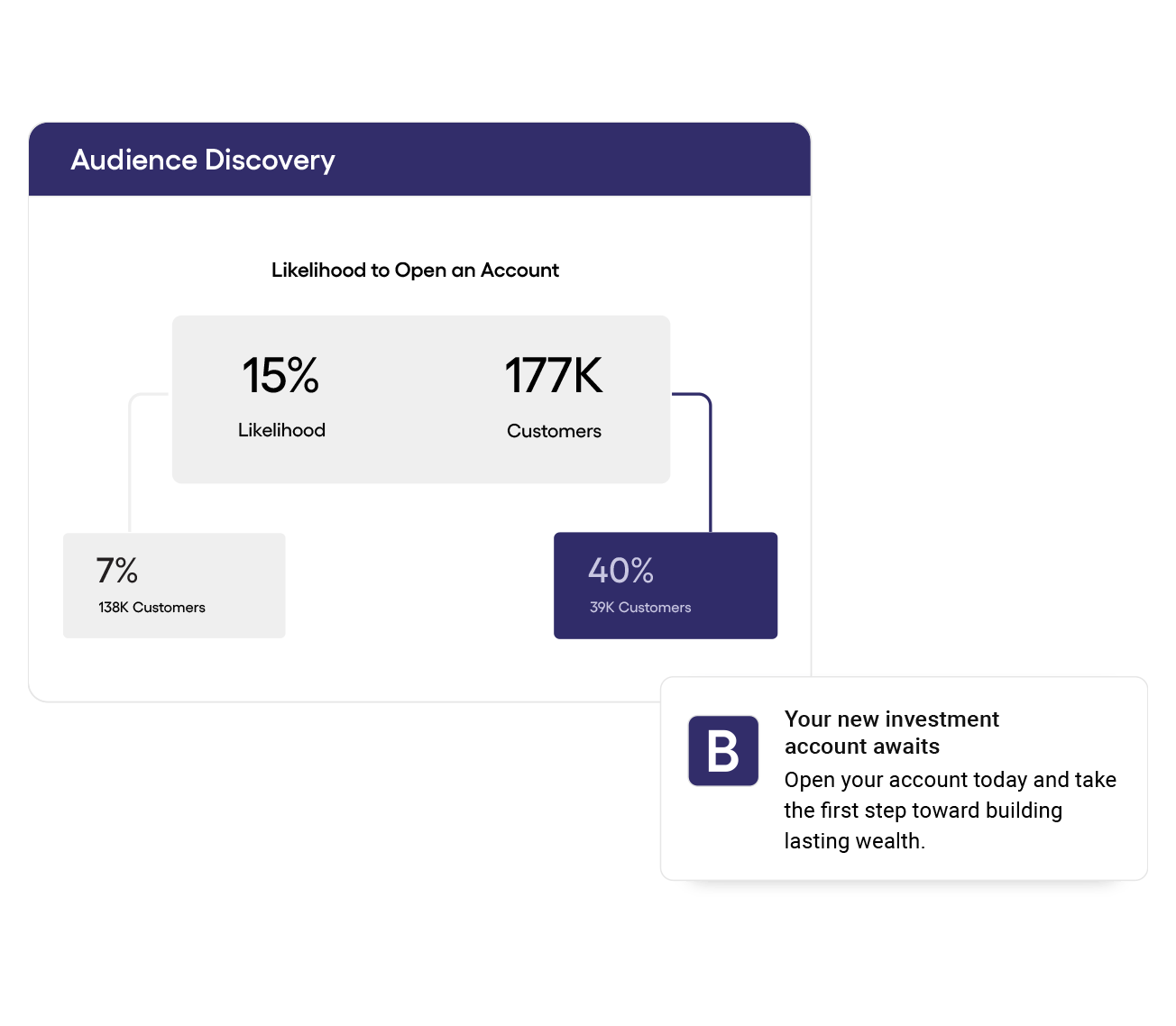

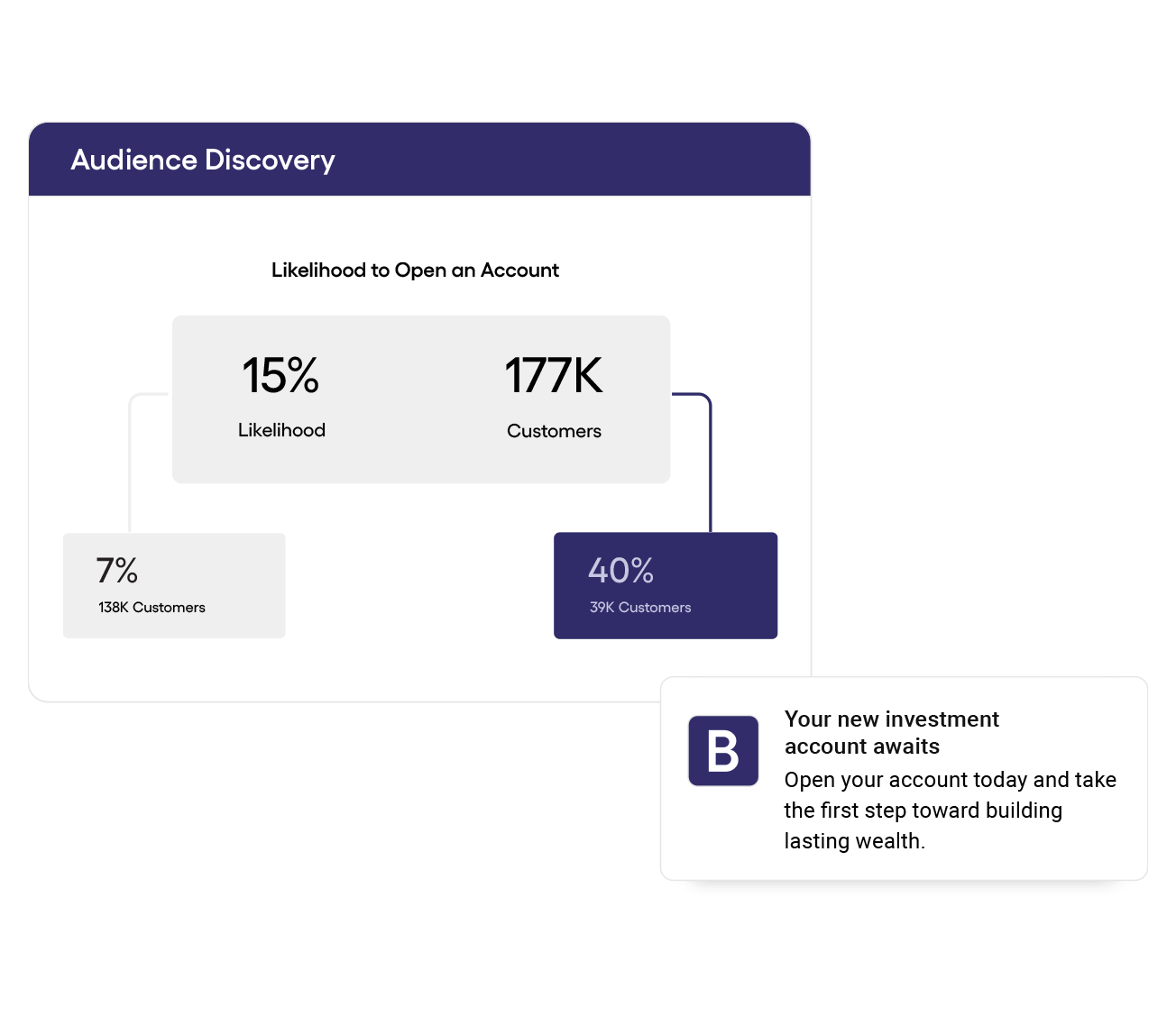

Discover the best clients for new products or accounts with OptiGenie AI-led audience discovery tools—no data science team required.

Launch, coordinate, and optimize engagement from a single platform

Build unified journeys that adapt in real-time across email, SMS, web and app without jumping between tools or teams.

Align service, marketing, compliance, and product teams around consistent, timely client communications.

Let OptiGenie AI agents determine the best campaign for each client as their behaviors shift, without manual rework or delays.

Turn every campaign into a growth engine

Use AI modeling to predict behaviors, personalize experiences, and deliver the right campaigns at exactly the right moment.

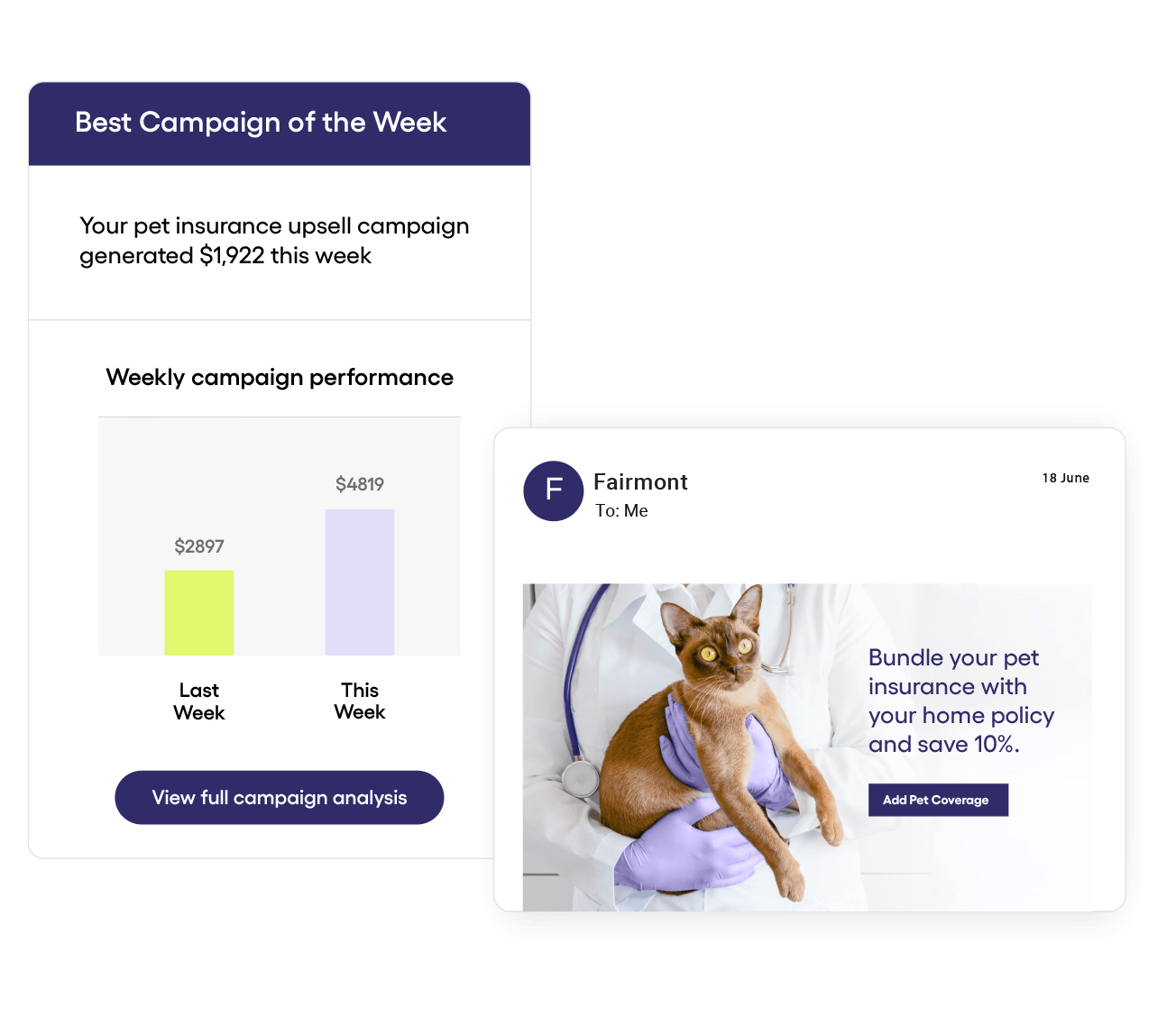

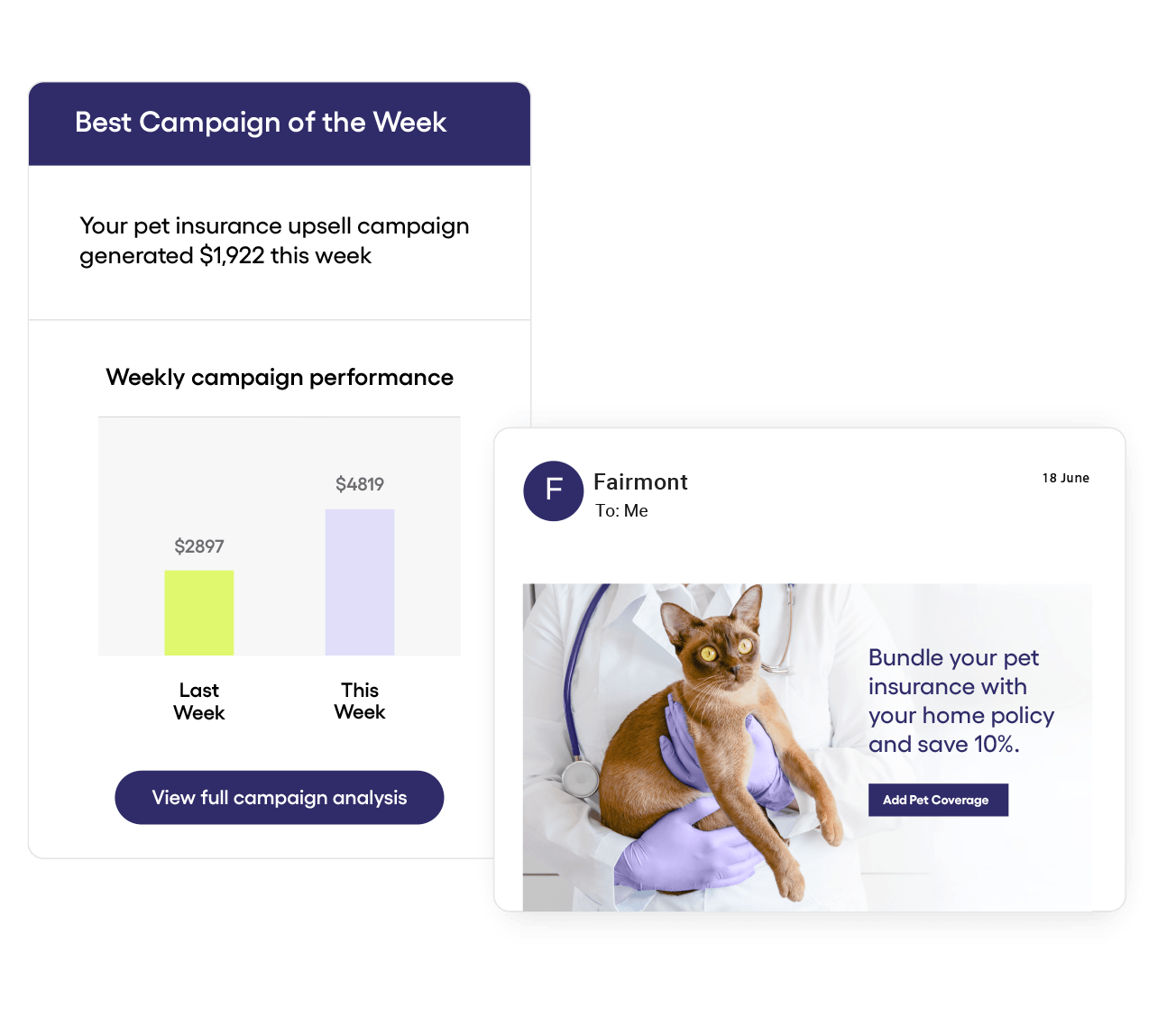

Test, analyze, and refine campaigns independently using AI-driven insights without waiting on analytics teams.

Let AI agents scan your campaigns and customer data, surfacing actionable insights that drive measurable results, automatically.

Build and optimize multichannel journeys with AI decisioning

Create and deliver personalized, multichannel campaigns at scale

Serve dynamic content and recommendations across your site and app

Launch interactive games and experiences to boost loyalty

Predict, personalize, and optimize with AI built for you

Give your teams more independence, ability, and agency with the powers to do anything and be everything

Check out our resources

How does Optimove’s Financial Services Marketing Solution support personalization?

Optimove unifies client data into comprehensive profiles that include, among others, reflect goals, life stage, and risk profile.

How does Optimove’s AI enhance marketing in banking, insurance, and wealth management?

OptiGenie, Optimove’s AI suite, provides marketers with enhancements across their workflow. OptiGenie’s predictive analytics anticipate key lifecycle moments such as churn, upsell, and life-event triggers (like mortgage renewals). OptiGenie proactively notifies marketers about campaigns that need optimization, suggests actions, and allows them to apply changes directly. Additionally, OptiGenie’s AI decisioning agents optimize campaigns and journeys to determine the optimal message for each customer.

How does Optimove help advisors act as a marketing channel?

Optimove surfaces AI-powered recommendations directly to advisors through our integrations and documented APIs. Advisors can use Optimove’s insights to guide conversations, blending human trust with data-driven precision.

How does Optimove ensure compliance?

Optimove’s security standards comply with the highest industry standards and regulations. Consent management, audit trails, and secure data handling are embedded and tracked in real-time. Optimove ensures marketing stays compliant with GDPR, CCPA, and industry-specific requirements.

How does Optimove’s Financial Services Marketing Solution measure KPIs?

In Optimove, every campaign is treated as a statistical experiment leveraging control groups that allow for accurate measurement of the incremental impact of each message, journey, and strategy. This reporting connects each client engagement to business KPIs such as cross-sell rates, account retention, and lifetime value, providing marketing departments with measurable financial impact.

Join the marketers who are leaving the limitations of fixed roles behind to boost their campaign efficiency by 88%