What is Customer Churn?

Customer churn (also known as customer attrition) refers to when a customer (player, subscriber, user, etc.) ceases his or her relationship with a company. Online businesses typically treat a customer as churned once a particular amount of time has elapsed since the customer’s last interaction with the site or service. The full cost of churn includes both lost revenue and the marketing costs involved with replacing those customers with new ones. Reducing churn is a key business goal of every online business.

The CRM Marketer evolution curve

The Importance of Predicting Customer Churn

The ability to predict that a particular customer is at a high risk of churning, while there is still time to do something about it, represents a huge additional potential revenue source for every online business. Besides the direct loss of revenue that results from a customer abandoning the business, the costs of initially acquiring that customer may not have already been covered by the customer’s spending to date. (In other words, acquiring that customer may have actually been a losing investment.) Furthermore, it is always more difficult and expensive to acquire a new customer than it is to retain a current paying customer.

Churn can be predicted by using a machine learning algorithm to calculate churn risks for each individual customer. However, for those looking for a simpler approach, calculating each customer’s churn factor is a powerful way to predict churn.

What is Churn Factor?

Churn factor looks at customer churn by considering a customer’s activity frequency. If a customer’s churn factor is high, it is more likely that the customer has already churned. A customer’s churn factor is measured by dividing the time since the customer’s last activity by the customer’s activity frequency. Using churn factor to analyze customer behavior considers each customer’s behavior in context, creating a simple yet very powerful churn prediction. Analyzing customers’ risk of churn in the context of their behavioral patterns gives you a deeper understanding of each of your customers’ behavior, increasing your potential to retain them longer.

To learn about the Churn Factor formula we created, watch the mini-workshop below, or read the transcript here.

Reducing Customer Churn with Targeted Proactive Retention

In order to succeed at retaining customers who would otherwise abandon the business, marketers and retention experts must be able to (a) predict in advance which customers are going to churn through churn analysis and (b) know which marketing actions will have the greatest retention impact on each particular customer. Armed with this knowledge, a large proportion of customer churn can be eliminated.

While simple in theory, the realities involved with achieving this “proactive retention” goal are extremely challenging.

The Difficulty of Predicting Churn

Churn prediction modeling techniques attempt to understand the precise customer behaviors and attributes which signal the risk and timing of customer churn. The accuracy of the technique used is obviously critical to the success of any proactive retention efforts. After all, if the marketer is unaware of a customer about to churn, no action will be taken for that customer. Additionally, special retention-focused offers or incentives may be inadvertently provided to happy, active customers, resulting in reduced revenues for no good reason.

Unfortunately, most of the churn prediction modeling methods rely on quantifying risk based on static data and metrics, i.e., information about the customer as he or she exists right now. The most common churn prediction models are based on older statistical and data-mining methods, such as logistic regression and other binary modeling techniques. These approaches offer some value and can identify a certain percentage of at-risk customers, but they are relatively inaccurate and end up leaving money on the table.

A Better Churn Prediction Model

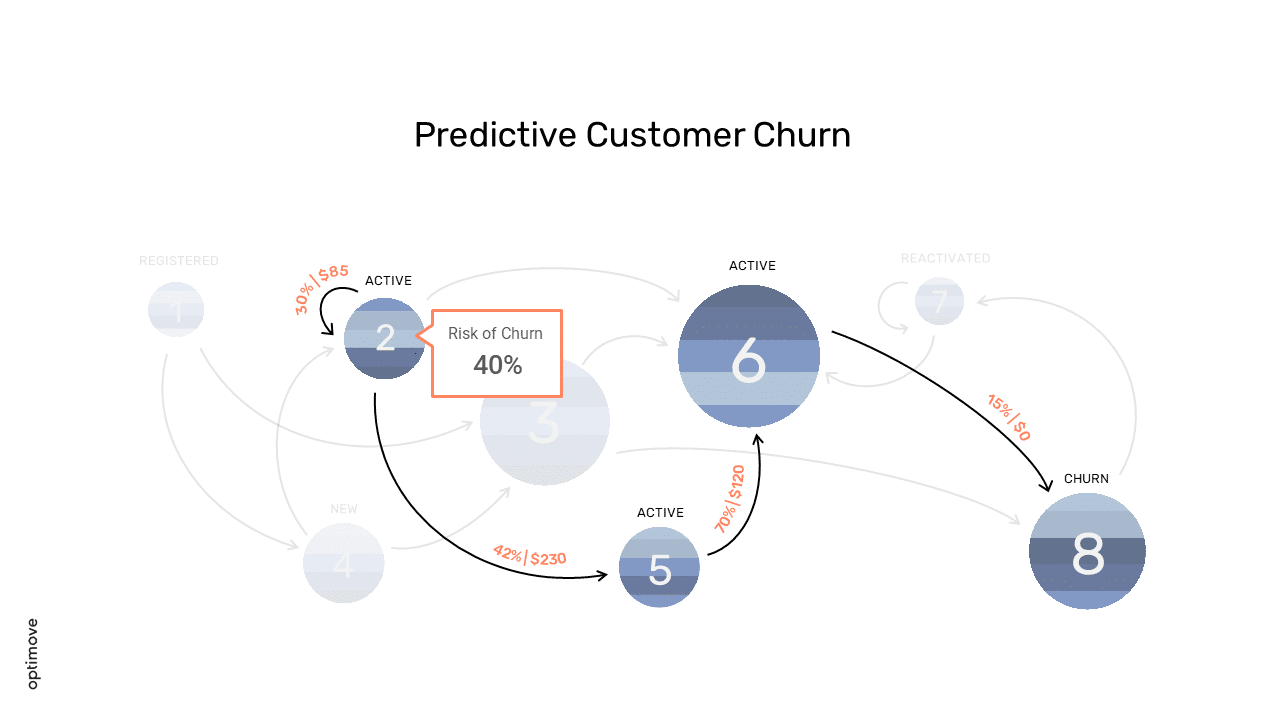

Optimove uses a newer and far more accurate approach to customer churn prediction: at the core of Optimove’s ability to accurately predict which customers will churn is a unique method of calculating customer lifetime value (LTV) for each and every customer. The LTV forecasting technology built into Optimove is based on advanced academic research and was further developed and improved over a number of years by a team of first-rate PhDs and software developers. This method is battle-tested and proven as an accurate and effective approach in a wide range of industries and customer scenarios.

Without revealing too much about the “secret sauce” of Optimove’s customer churn prediction technology, the approach combines continual dynamic micro-segmentation and a unique, mathematically intensive predictive behavior modeling system. The former intelligently and automatically segments the entire customer base into a hierarchical structure of ever-smaller behavioral-demographic segments. This segmentation is dynamic and updated continually based on changes in the data. The latter is based on the fact that the behavior patterns of individual customers frequently change over time. In other words, the “segment route history” of each customer is an extremely important factor determining when and why the customer may churn.

By merging the most exacting micro-segmentation available anywhere with a deep understanding of how customers move from one micro-segment to another over time – including the ability to predict those moves before they occur – an unprecedented degree of churn analysis accuracy is attainable.

Beyond Customer Churn Analysis: Preventing Customer Value Attrition

Optimove goes beyond simply predicting which customers will abandon the business by providing early warnings regarding customers whose lifetime value prediction has declined substantially during the recent period, even though they are still active and may not abandon the business entirely in the near future.

Optimove’s ability to identify customers which fall into this “decliner” category helps marketers increase revenues from existing customers, while simultaneously reducing the number of customers who may fall into the risk-of-churn category.

The CRM Marketer Evolution Curve’s Guide

Learn about the 5 stages of a marketer’s evolution. Discover which level you are on and how you can move up.

Now What? Targeted Proactive Retention

Predicting churn is important only to the extent that effective action can be taken to retain the customer before it is too late. A central – and unique – aspect of Optimove is the software’s combination of cutting-edge churn prediction capabilities and a marketing action optimization engine.

Once those customers at risk of churning have been identified, the marketer has to know exactly what marketing action to run on each individual customer to maximize the chances that the customer will remain a customer. Since different customers exhibit different behaviors and preferences, and since different customers churn for different reasons, it is critical to practice “targeted proactive retention.” This means knowing in advance which marketing action will be the most effective for each and every customer.

Leveraging Churn Analysis

Optimove’s proactive retention approach is based on combining customer churn prediction and marketing action optimization. Optimove thus goes beyond “actionable customer analytics” to automatically determine exactly what marketing action should be run for each at-risk customer to achieve the maximum degree of retention possible.

Frequently Asked Questions

How does Optimove help me reduce churn?

A certain percentage of paying customers will always abandon your site or app, never to return. While Optimove can’t prevent this from occurring, the software can identify customers who are on their way out and then help you optimize the particular marketing actions that are expected to have the greatest chances of preventing those customers from churning before it’s too late. Optimove can also suggest marketing actions earlier on in the customer lifecycle which will increase customer loyalty, extend their engagement with your business and reduce the chances that they will abandon you in the first place. Unlike other systems, Optimove calculates a unique “churn factor” for each individual customer (learn more in our Guide to Re-engaging Churned Customers).

What are the three types of machine learning models used by recommendation engines?

The three types of recommendation engines are collaborative filtering, content-based filtering, and hybrid filtering.

*Collaborative filtering: Makes individual recommendations based on similar users’ preferences and behavioral data.

*Content-based filtering: Matches features of specific items to certain user preferences.

*Hybrid filtering: Combines collaborative and content-based filtering for improved recommendations.

You Can Dramatically Reduce Customer Churn with Optimove!

Contact us today – or request a Web demo – to learn how you can use Optimove to significantly reduce churn through cutting-edge customer churn prediction and automatic marketing action optimization.

Get a personalized tour of Optimove

Let us show you how to go from tens to hundreds of segments